Barrier Coating for Recyclable Flexible Packaging Market Trends Report 2035

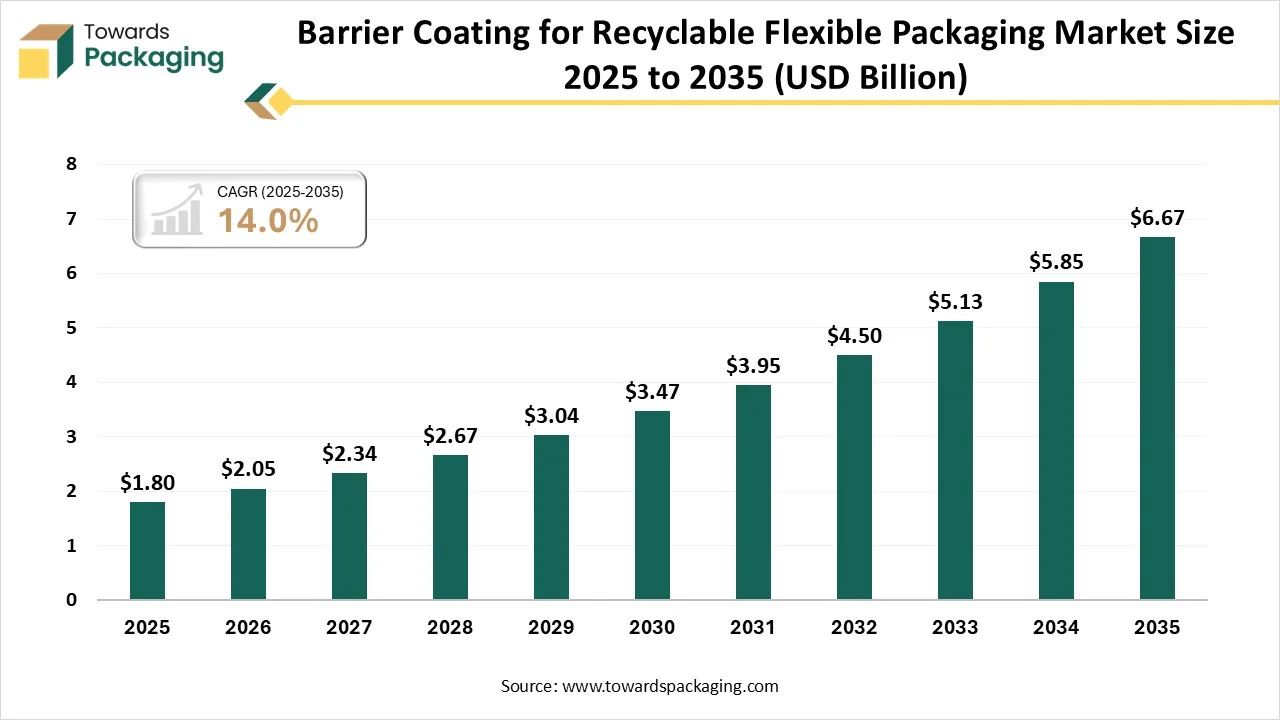

As highlighted by Towards Packaging research, the global barrier coating for recyclable flexible packaging market, valued at USD 1.80 billion in 2025, is expected to reach USD 6.67 billion by 2035, registering a CAGR of 14.0% throughout the forecast period.

Ottawa, Feb. 12, 2026 (GLOBE NEWSWIRE) -- The global barrier coating for recyclable flexible packaging market hit USD 1.80 billion in 2025, with current forecasts pointing to USD 6.67 billion by 2035, according to Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is meant by Barrier Coating for Recyclable Flexible Packaging?

Barrier coating for recyclable flexible packaging refers to thin protective layers applied to packaging films to block moisture, oxygen, grease, and contaminants while maintaining recyclability. The market is driven by growing demand for sustainable packaging, increasing focus on food safety and shelf-life extension, regulatory pressure to reduce plastic waste, and brand initiatives to shift toward mono-material and recyclable packaging solutions across the food, beverage, and consumer goods industries.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5952

Private Industry Investments for Barrier Coating for Recyclable Flexible Packaging:

- Ionkraft ($3.6M Equity): In late 2024, this startup secured funding co-led by M-Ventures to scale plasma-based barrier coatings that enable the creation of fully recyclable plastic containers.

- Mondi (€16M Facility Investment): Mondi invested €16 million in its Solec plant to produce "FunctionalBarrier Paper Ultimate," a paper-based, ultra-high barrier solution designed for food and pharmaceutical applications.

- Nfinite Nanotech ($6.5M Seed): In mid-2024, this company raised funds led by Collateral Good to advance ultra-thin nanocoatings that provide high barriers without compromising the recyclability of the base substrate.

- Kelpi (€5M Growth Round): This biotech firm raised over €5 million in 2024 to upscale its seaweed-based, compostable barrier coatings for recyclable paper packaging in the food and beverage sectors.

-

Bambrew ($10.3M Series A): This firm raised approximately $10.3 million in 2024 to expand production of its fiber-based recyclable packaging that utilizes specialized coatings to replace plastic and foil.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

What Are the Latest Key Trends in the Barrier Coating for Recyclable Flexible Packaging Market?

1. Sustainable and recyclable materials

The dairy industry is shifting toward recyclable mono-material films and plant-based packaging to reduce waste, meet environmental policies, and appeal to consumers seeking eco-friendly products, while still protecting milk and dairy items effectively.

2. Advanced barrier technologies

New high-barrier films and coatings improve protection against moisture, oxygen, and light without compromising recyclability, helping dairy products stay fresh longer while fitting into recycling streams.

3. Light-blocking and protective designs

Innovations like recyclable PET bottles that block light protect sensitive dairy products from spoilage, combining functional performance with ease of recycling in existing systems.

4. Smart and interactive packaging

Incorporating features such as QR codes or freshness indicators enhances consumer information, traceability, and waste reduction, supporting better recycling behavior and supply-chain visibility.

What is the Potential Growth Rate of the Barrier Coating for Recyclable Flexible Packaging Industry?

The barrier coating for recyclable flexible packaging industry is poised for significant growth as companies increasingly adopt eco-friendly and recyclable packaging solutions. Rising consumer demand for sustainable products, combined with regulatory pressure to reduce plastic waste, is driving innovation in high-performance barrier coatings. These coatings help maintain product freshness and safety across food, beverage, and healthcare applications, while enabling recyclability, positioning the market for steady expansion and broader industry adoption in the coming years.

Regional Analysis:

Who is the leader in Barrier Coating for Recyclable Flexible Packaging Market?

The Asia-Pacific region dominates the barrier coating for recyclable flexible packaging industry due to its rapidly growing food and beverage sector, expanding e-commerce, and increasing demand for sustainable packaging solutions. Rising consumer awareness about product safety and freshness drives the adoption of high-performance barrier coatings. Additionally, government regulations promoting eco-friendly and recyclable materials encourage manufacturers to use recyclable packaging, making the region a key hub for innovation and widespread application of barrier-coated flexible packaging.

China Barrier Coating for Recyclable Flexible Packaging Market Trends

China leads the Asia-Pacific market due to its large-scale manufacturing capabilities, well-established packaging infrastructure, and high production capacity. Strong demand from the food, beverage, and pharmaceutical sectors, combined with increasing focus on sustainability and recyclable solutions, drives widespread adoption of barrier coatings. Rapid industrial growth and export-oriented production further reinforce China’s position as the dominant country in the region.

How is the Opportunistic is the Rise of the North America in the Barrier Coating for Recyclable Flexible Packaging Industry?

North America is the fastest-growing region in the market due to increasing demand for sustainable and recyclable packaging, strict government regulations on waste reduction, and high consumer awareness of eco-friendly products. Additionally, the rapid adoption of advanced barrier coatings, mono-material films, and innovative packaging technologies in the food, beverage, and healthcare sectors is driving accelerated growth across the region.

U.S. Barrier Coating for Recyclable Flexible Packaging Market Trends

In the U.S., the market is trending toward sustainable and eco-friendly solutions, including water-based and bio-based coatings. Companies are increasingly adopting mono-material and fully recyclable structures to simplify recycling. Growth is also driven by strict food safety regulations, consumer demand for environmentally responsible packaging, and rising use of high-barrier coatings in ready-to-eat foods, beverages, and e-commerce packaging.

More Insights of Towards Packaging:

- Repackaging Service Market Size and Segments Outlook (2026–2035)

- Corrugated Automotive Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Barrier-Coated Flexible Paper Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Bio-Based Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Active and Intelligent Packaging Market Size and Segments Outlook (2026–2035)

- Plain Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Packaging Waste Management Market Size, Trends and Competitive Landscape (2026–2035)

- Track and Trace Packaging Market Size, Trends and Segments (2026–2035)

- Single-Use Plastic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Unbleached Kraft Paperboard Market Size, Trends and Segments (2026–2035)

- Egg Boxes and Trays Market Size and Segments Outlook (2026–2035)

- Corrugated Packaging for Pharmaceutical Market Size, Trends and Competitive Landscape (2026–2035)

- Germany E-Commerce Packaging Market Size and Segments Outlook (2026–2035)

- Corrugated Box Packaging for Electronics Market Size, Trends and Regional Analysis (2026–2035)

- Reusable Cold Chain Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Polypropylene Corrugated Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- North America Packaging Tape Printing Market Size and Segments Outlook (2026–2035)

- Packaging Tape Printing Market Size and Segments Outlook (2026–2035)

- Europe Fresh Food Packaging Market Size and Segments Outlook (2026–2035)

- Unit Dose Packaging Market Size, Trends and Regional Analysis (2026–2035)

Segment Outlook

Coating Type Insights

The water‑based barrier coating segment dominates the barrier coating for recyclable flexible packaging market because it offers environmentally friendly performance with low VOC emissions, aligning with sustainability goals and strict regulatory standards. It supports recyclability better than solvent‑based alternatives and meets growing consumer demand for eco‑conscious packaging. Additionally, water‑based coatings provide effective moisture and oxygen barriers, making them suitable for a wide range of food, beverage, and consumer products.

The bio‑based/biopolymer coating segment is the fastest growing in the market because it offers renewable, sustainable alternatives to traditional coatings, reducing dependency on fossil‑based materials. These coatings enhance recyclability and biodegradability, meeting stricter environmental regulations and consumer demand for greener packaging. Innovation in performance and compatibility with recyclable films also encourages their adoption across food, beverage, and consumer goods applications.

Barrier Function Insights

The oxygen barrier segment is dominant in the barrier coating for the recyclable flexible packaging market because preventing oxygen ingress is critical for preserving the freshness, flavor, and shelf life of food and beverage products. Strong oxygen barriers reduce spoilage and extend durability, making them essential for perishable goods. High demand from the food, dairy, and meat industries, along with consumer expectations for quality and safety, drives widespread use of oxygen barrier coatings.

The moisture/water‑vapour barrier segment is the fastest growing in the market because protecting products from moisture is crucial for maintaining freshness, texture, and shelf life, especially in foods, pharmaceuticals, and sensitive goods. Rising demand for packaged convenience and frozen foods increases the need for effective moisture barriers. Additionally, advancements in coating technologies that deliver strong performance while supporting recyclability and sustainability goals further accelerate adoption.

Flexible Packaging Type Insights

The films segment is dominant in the barrier coating for recyclable flexible packaging market because it provides a lightweight, flexible, and versatile packaging solution suitable for a wide range of applications in food, beverage, and consumer goods. Films coated with barrier materials effectively protect against moisture, oxygen, and contaminants while maintaining recyclability. Their cost-effectiveness, ease of processing, and compatibility with modern packaging machinery further drive widespread adoption in the industry.

The pouches & bags segment is the fastest growing because these formats offer convenience, lightweight handling, and efficient storage for consumers and manufacturers. Their flexibility and adaptability make them ideal for a wide range of foods and consumer products. When combined with advanced barrier coatings, pouches and bags provide enhanced freshness and protection while supporting recyclability, driving increased adoption in sustainable packaging.

End-User Industry Insights

The food & beverages segment dominates the barrier coating for recyclable flexible packaging market because these products require high protection against moisture, oxygen, and contaminants to maintain freshness, taste, and safety. Rising consumer demand for packaged and ready-to-eat foods, along with strict food safety regulations and a growing focus on sustainable and recyclable packaging, drives widespread adoption of barrier-coated solutions in this segment.

The healthcare and pharmaceutical segment is fastest growing segment in the market because products in this sector need high levels of protection against moisture, oxygen, and contamination to ensure drug stability and safety. Rising demand for advanced, sterile, and patient‑safe packaging, along with stricter regulatory requirements and a shift toward recyclable, sustainable materials, drives increased use of barrier coatings in pharmaceutical and medical packaging solutions.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in Barrier Coating for Recyclable Flexible Packaging Industry

- In September 2025, CelluForce introduced CelluShield in September 2025, a high-performance cellulose-based barrier coating for flexible packaging. It provides strong oxygen and moisture resistance while being fully renewable and compatible with recyclable films. The development is aimed at food, beverage, and pharmaceutical packaging, helping companies transition to sustainable packaging materials without compromising product shelf life or quality.

- In September 2025, Heidelberg, in collaboration with Solenis, developed a new industrial method for applying barrier coatings to paper packaging in September 2025. The process allows manufacturers to integrate eco-friendly barrier layers without extensive modifications to existing production lines. It supports moisture, oxygen, and grease protection, enabling recyclable packaging adoption at scale.

-

In August 2025, Mondi plc, a packaging company, launched FunctionalBarrier Paper Ultimate in August 2025, a paper-based barrier solution for high-protection packaging. This coating provides excellent resistance to water vapor, oxygen, and grease, making it ideal for sensitive foods like snacks, bakery products, and ready-to-eat meals. Designed to be fully recyclable, it supports brand sustainability goals while maintaining packaging functionality.

Top Companies in the Global Barrier Coating for Recyclable Flexible Packaging Market & Their Offerings:

Tier 1:

- Jindal Poly Films: Provides BOPE-based films with specialized coatings that create mono-material laminates to replace non-recyclable multi-material structures.

- Greencoat (Greendot Biopak): Manufactures plastic-free, water-based emulsion coatings that offer oil and moisture resistance while remaining fully repulpable.

- Kalpana Systems: Uses Atomic Layer Deposition to apply ultra-thin, nanoscale barrier layers that provide high protection without affecting the recyclability of the substrate.

- Uflex Limited: Offers mono-material BOPP films with high-barrier coatings designed to provide gas and moisture protection in a single-polymer stream.

- Huhtamaki: Features the blueloop™ range, utilizing ultra-thin dispersion coatings to create high-barrier paper solutions compatible with standard paper recycling.

- Sealed Air Corporation: Produces mono-material, recycle-ready films with integrated barrier technology specifically for fluid and perishable food applications.

-

Mondi Group: Develops FunctionalBarrier Paper, which uses aqueous coatings to provide customized barriers while maintaining full recyclability in paper streams.

Tier 2:

- Amcor plc

- DuPont

- Teijin Films

- Eastman Chemical Company

- Henkel AG & Co. KGaA

- Evonik Industries AG

Segment Covered in the Report

By Coating Type

- Water-Based Barrier Coatings

- Acrylic-Based Coatings

- Polyurethane (PU) Water-Based Coatings

- Epoxy Water-Based Coatings

- Latex-Based Coatings

- Bio-Based / Biopolymer Barrier Coatings

- Polylactic Acid (PLA) Coatings

- Polyhydroxyalkanoates (PHA) Coatings

- Starch-Based Coatings

- Cellulose-Based Coatings

- Solvent-Based Barrier Coatings

- Polyurethane Solvent-Based Coatings

- Epoxy Solvent-Based Coatings

- Acrylic Solvent-Based Coatings

- Silicone Coatings

- Heat-Resistant Silicone Coatings

- Food-Grade Silicone Coatings

- Hydrophobic / Water-Repellent Silicone Coatings

- UV-Curable Barrier Coatings

- Acrylate-Based UV Coatings

- Epoxy-Based UV Coatings

- Hybrid UV-Curable Coatings

- Nanocomposite Barrier Coatings

- Clay Nanocomposites

- Graphene / Carbon-Based Nanocoatings

- Metal Oxide Nanocoatings

By Barrier Function

- Oxygen Barrier

- Moisture / Water Vapor Barrier

- Grease & Oil Barrier

- Aroma & Flavor Barrier

- Gas / Ethylene Barrier

- Multi-Functional Barrier Systems

By Flexible Packaging Type

- Films (LDPE, PET, BOPP, CPP)

- Pouches & Bags (Stand-up, Zipper, Spout)

- Wraps & Sheets

- Laminates

- Sachets & Sachet Packs

By End-Use Industry

- Food & Beverage

- Healthcare & Pharmaceuticals

- Personal Care & Cosmetics

- Household & Homecare

- Pet Food Packaging

- Industrial & Specialty Packaging

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5952

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight - Check It Out:

- Europe Food Packaging Market Size and Segments Outlook (2026–2035)

- Shrink Label Films Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Rigid Packaging Market Size, Trends and Segments (2026–2035)

- North America Packaging Market Size, Trends and Regional Analysis (2026–2035)

- North America Plastic Packaging Market Size, Trends and Segments (2026–2035)

- Biopolymer Packaging Market Size, Trends and Segments (2026–2035)

- Next-Generation Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Recycled Materials Packaging Solutions Market Size and Segments Outlook (2026–2035)

- Commercial Printing Market Size, Trends and Competitive Landscape (2026–2035)

- Packaging Films Market Size and Segments Outlook (2026–2035)

- Contract Packaging and Fulfilment Services Market Size, Trends and Regional Analysis (2026–2035)

- Canada Pharmaceutical Packaging Market Size, Trends and Segments (2026–2035)

- South Korea Cosmetic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Germany Flexible Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Cosmetic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Pharmaceutical Packaging Market Size, Trends and Regional Analysis (2026–2035)

- U.S. Glass Packaging Market Size and Segments Outlook (2026–2035)

- Flexible Packaging Adhesive Market Size, Trends and Regional Analysis (2026–2035)

- France Pharmaceutical Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Japan Packaging Machinery Market Size, Trends and Competitive Landscape (2026–2035)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.