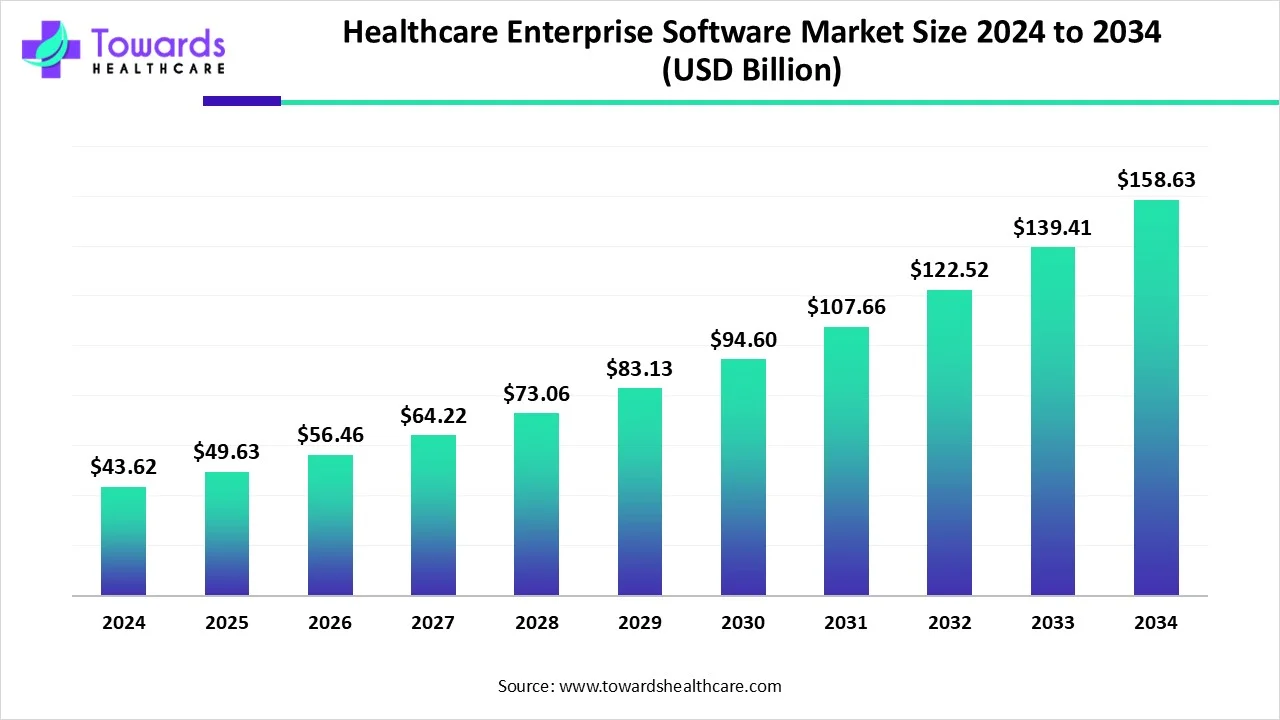

Healthcare Enterprise Software Market on Track for USD 158.63 Billion by 2034

The global healthcare enterprise software market size was valued at USD 49.63 billion in 2025 and is predicted to hit around USD 158.63 billion by 2034, rising at a 13.8% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Jan. 15, 2026 (GLOBE NEWSWIRE) -- The global healthcare enterprise software market size is calculated at USD 56.46 billion in 2026 and is expected to reach around USD 158.63 billion by 2034, growing at a CAGR of 13.8% for the forecasted period.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5590

Key Takeaways

- North America held a major revenue share of the healthcare enterprise software market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the studied years.

- By product type, the revenue cycle management (RCM) segment was dominant in the market in 2024.

- By product type, the business intelligence (BI) segment is expected to witness rapid expansion during 2025-2034.

- By delivery mode type, the on-premise segment led the market in 2024.

- By delivery mode type, the cloud-based segment is expected to grow fastest in the predicted timeframe.

- By application type, the healthcare providers segment registered dominance in the market in 2024.

- By application type, the healthcare payers segment is expected to grow at the fastest CAGR in the coming years.

What are the Ongoing Breakthroughs in Healthcare Enterprise Software?

The global healthcare enterprise software market includes the integration of firms' core business functions into a single, combined system to simplify operations, accelerate data management, lower expenditures, and improve patient care through centralized processes and real-time insights. Moreover, the market is mainly propelled by a rise in diverse technological advances, regulatory burdens, and the rising demand for effective, united healthcare management solutions. However, companies, such as Philips Healthcare and Dexcom, are facilitating advanced continuous glucose monitors and smartwatches for prioritizing alerts to clinicians.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Key Drivers in the Healthcare Enterprise Software Market?

Healthcare providers are increasingly stepping into raising patient involvement, satisfaction, and results, where different software solutions offer tailored care, remote patient monitoring (RPM), and accessible patient portals. Moreover, the global market is fueled by consistent innovations in artificial intelligence (AI), machine learning (ML), big data analytics, and the Internet of Medical Things (IoMT) into software solutions, which support optimizing diagnostics, improving workflows, and allowing data-driven decision-making.

What are the Major Drifts in the Healthcare Enterprise Software Market?

- In January 2026, Rinova AI and Wise Medical Billing developed an innovative strategic partnership to explore Agentic Autonomy in healthcare RCM.

- In November 2025, Wasson Enterprise collaborated with MOBE to foster whole-person health solutions.

-

In May 2025, Coalesce Capital acquired a significant stake in DAS Health Ventures to promote DAS Health's expansion by investing in technology, talent, and planned acquisitions.

What is a Vital Limitation in the Healthcare Enterprise Software Market?

Arising breaches in patients’ sensitive data are showing the greater need for spending and protection, which also creates issues with regulations, such as HIPAA and GDPR. Moreover, a shortage of perfect data exchange among disparate IT systems and platforms like EHRs, lab systems, and imaging systems, develops data silos, barriers in care coordination, and lowers effectiveness.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Regional Analysis

What Made North America Dominant in the Market in 2024?

In 2024, North America captured the biggest revenue share of the healthcare enterprise software market, due to accelerating adoption of high technology, emerging government encouragement, such as the ACA, and a rising shift towards value-based care. Robust players, including NextGen and ScienceSoft, are rigorously adhering to HL7 and FHIR (Fast Healthcare Interoperability Resources) to ensure systems can communicate efficiently. A recent groundbreaking study comprises Innovaccer's data platform, which assists health systems in integrating clinical and claims data to help population health management and value-based contracts.

In the U.S. healthcare enterprise software market, growth is driven by digital transformation, regulatory compliance, and rising demand for interoperability among EHR, EMR, and RCM systems. AI and analytics reduce administrative burdens and improve decision-making, while cloud-based solutions enhance scalability, cost-efficiency, and value-based care adoption. Telehealth integration and the push for unified ERP with clinical operations also boost enterprise software uptake amid chronic disease prevalence and operational complexity.

How did the Asia Pacific Grow Notably in the Market in 2024?

Asia Pacific is anticipated to expand rapidly in the healthcare enterprise software market in the future. Ongoing digital revolutions, like EHRs and telemedicine, with widespread adoption of AI/IoT, have raised demand for unified data management. Recently, the National Medical Products Administration (NMPA) released clear regulatory pathways and escalated approval programs for novel medical devices and AI-enabled software, with 92 Class III AI medical devices approved by mid-2024. Whereas, in India, more sophisticated platforms, especially Practo, are exploring services, like appointments, teleconsults, & records.

In China’s healthcare enterprise software sector, robust digitization, strong government e-health strategies, and rising chronic disease burdens fuel rapid growth, with higher CAGRs than in the U.S. AI-powered clinical decision systems, cloud-enabled platforms, and telemedicine SaaS are key trends, and scalable solutions for rural and international patient management continue expanding market reach. Data privacy, localized compliance, and modular software partnerships further shape adoption patterns.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Segmental Insights

By product type analysis

Which Product Type Led the Healthcare Enterprise Software Market in 2024?

The revenue cycle management (RCM) segment held a dominant share of the market in 2024. It is driven by numerous offerings, like patient registration, insurance verification, coding, claims submission, denial management, and accounts receivable. The latest advances in RCM are bolstering mobile apps and text-to-pay options, which enable patients to view bills, recognize their insurance coverage, set up payment plans, and make payments from their smartphones.

In the prospective period, the business intelligence (BI) segment is estimated to expand fastest. A rise in demand for predictive analytics and big data integration is supporting the segmental progression. However, the broader adoption of BI and AI is automating routine administrative tasks, especially scheduling, billing, and claims processing, which ultimately lowers staff burnout and operational expenditures. An immersive novel enterprise imaging solution was developed by Konica Minolta, united with PACS/RIS, with the use of AI-assisted workflow orchestration and BI.

By delivery mode type analysis

Why did the On-Premise Segment Dominate the Market in 2024?

In 2024, the on-premise segment accounted for the biggest share of the healthcare enterprise software market. Nowadays, providers are robustly demanding data control, security, and compliance, which enables personalization and minimal vendor dependency, mainly for sensitive patient data (PHI). Alongside, various on-premise approaches are gaining updates, which encompass stronger encryption (AES-256), multi-factor authentication (MFA), and deeper audit trails to protect sensitive patient information and maintain HIPAA and GDPR compliance.

Furthermore, the cloud-based segment is anticipated to witness rapid expansion. These solutions facilitate pay-as-you-go models and versatility to raise resources, lowering infrastructure expenditures, which makes sophisticated solutions accessible to smaller providers. However, Microsoft raised its Microsoft Dragon Copilot as an integrated voice, ambient, and generative AI assistant for clinical workflows, which emphasizes ambient clinical intelligence for documentation.

By application type analysis

Which Application Type Led the Healthcare Enterprise Software Market in 2024?

The healthcare providers segment was dominant in the market in 2024. Specifically, Epic, Cerner, Oracle, Allscripts, and Philips, acting as giant enterprises and clinics. Rising improvements in IT infrastructure, controlling chronic diseases, escalating patient safety, and meeting regulatory requirements are serving as substantial catalysts. Alongside, they are stepping into scalable cloud infrastructure (AWS, Azure) for managing a huge amount of data, with a microservices architecture, reducing downtime.

On the other hand, the healthcare payers segment will expand rapidly. These facilities are promoting core administration platforms for enrolling, billing, and member management. Also, they are putting efforts into business process outsourcing (BPO), which shows minimal spending in administrative functions, such as claims processing and customer service. However, they are leveraging AI agents for early auth/claims processing, predictive models for sepsis/outcomes, surrounding listening for clinical notes, and united platforms from vendors, including athena health and Infosys.

Browse More Insights of Towards Healthcare:

The global software as a service for behavioral health market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034.

The global mental health software market size was estimated at USD 6.06 billion in 2025 and is predicted to increase from USD 6.77 billion in 2026 to approximately USD 18.38 billion by 2035, expanding at a CAGR of 11.74%% from 2026 to 2035.

The global medical transcription software market size is estimated at US$ 2.59 billion in 2024, is projected to grow to US$ 3.01 billion in 2025, and is expected to reach around US$ 11.36 billion by 2034. The market is projected to expand at a CAGR of 16.34% between 2025 and 2034.

The global precision medicine software market size is calculated at US$ 2.18 billion in 2025, grew to US$ 2.46 billion in 2026, and is projected to reach around US$ 7.14 billion by 2035. The market is expanding at a CAGR of 12.6% between 2026 and 2035.

The global mental health EHR software market size was estimated at USD 1.77 billion in 2025 and is predicted to increase from USD 2.04 billion in 2026 to approximately USD 7.16 billion by 2035, expanding at a CAGR of 15% from 2026 to 2035.

The global clinical trial software market size in 2024 was US$ 0.9 billion, expected to grow to US$ 1.03 billion in 2025 and further to US$ 3.23 billion by 2034, backed by a robust CAGR of 13.74% between 2025 and 2034.

The clinical perinatal software market size was estimated at USD 187.47 million in 2025 and is predicted to increase from USD 206.85 million in 2026 to approximately USD 501.48 million by 2035, expanding at a CAGR of 10.34% from 2026 to 2035.

The global AI in medical scheduling software market size is calculated at USD 204.79 million in 2025, grew to USD 262.42 million in 2026, and is projected to reach around USD 2444.35 million by 2035. The market is expanding at a CAGR of 28.14% between 2026 and 2035.

The global AI in patient scheduling software market size is calculated at USD 80.55 million in 2025, grew to USD 102.82 million in 2026, and is projected to reach around USD 925.25 million by 2035. The market is expanding at a CAGR of 27.65% between 2026 and 2035.

The global dental practice management software market size was estimated at USD 1.82 billion in 2025 and is predicted to increase from USD 1.97 billion in 2026 to approximately USD 4.16 billion by 2035, expanding at a CAGR of 8.64% from 2026 to 2035.

What are the Recent Developments in the Healthcare Enterprise Software Market?

- In November 2025, Butterfly Network, Inc. unveiled Compass AI, a next-generation version of its enterprise software platform, led by artificial intelligence (AI) to lower workflow friction and support scalable, revenue-ready point-of-care ultrasound (POCUS) programs for health systems.

- In September 2025, CitiusTech launched CitiusTech Knewron, a healthcare-native AI platform created to support organizations in developing and operating enterprise-grade AI solutions.

- In September 2025, IKS Health introduced Scribble Now, its ambient AI scribe, which is natively united across revenue cycle management, coding, and clinical documentation solutions.

Healthcare Enterprise Software Market Key Players List

- EPIC Systems Corporation

- CPSI

- Medical Information Technology Inc.

- Meta

- SAP

- Cognizant

- Oracle

- INFOR

- eClinicalWorks.

- Allscripts Healthcare LLC

- Change Healthcare

- Optum Inc.

- Cerner Corporation

- Athenahealth

- Koninklijke Philips N.V.

Segments Covered in the Report

By Product

- Revenue Cycle Management (RCM)

- Customer Relationship Management (CRM)

- Business Intelligence

- Enterprise Content Management

By Delivery Mode

- On-Premise

- Cloud-Based

By Application

- Healthcare Providers

- Healthcare Payers

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5590

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Towards Packaging | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Healthcare Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.